Forex Trading Sessions Trading Forex Market Session Time In the forex market, there are specific timeframes which are used to determine the correct moment to make a trade. These timeframes are called ‘trading sessions’. A trading session can be defined as a set of consecutive hours during which forex market activities are scheduled. A trading session can also be determined by the currency pair being traded. For example, a trading session for the EUR/USD pair might last from 9:00 am to 5:00 pm eastern standard time (EST). There are two main types of forex trading: intra-day and inter-day. Intra-day trading refers to trading within a single trading session. Inter-day trading refers to trading within two or more trading sessions. When you open a forex position, you are taking a position in the market for the currency that you are trading. You are also taking a position in the direction that the trend is going. You must always be ready to exit your position at the right time.

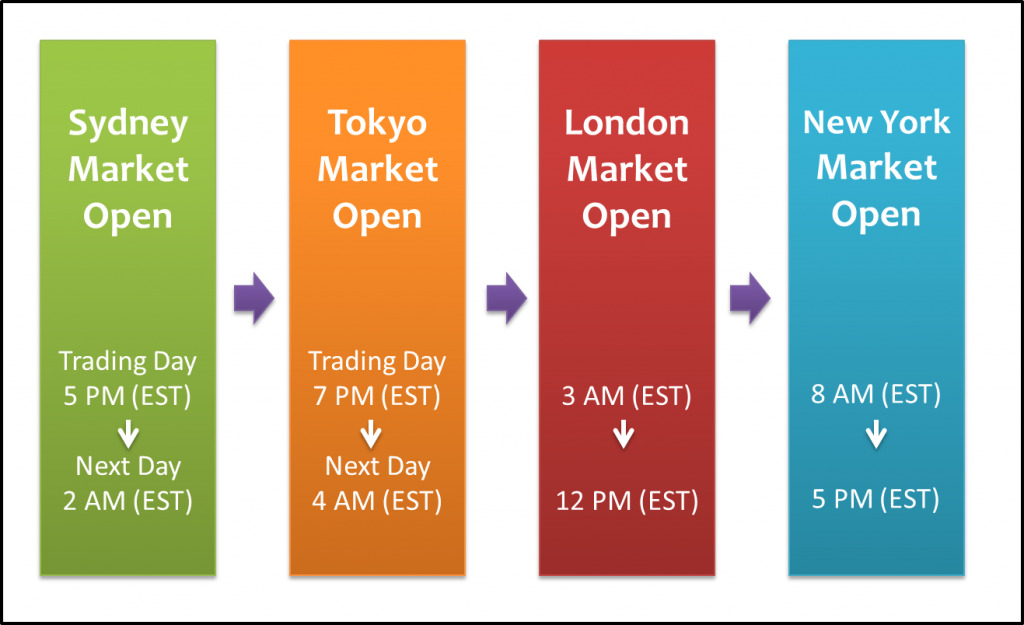

Opening hours for forex markets vary from country to country. Here are the general open hours for forex markets around the world:

Australia: 9:00 a.m. to 4:00 p.m. (AEST)

Europe: 7:00 a.m. to 4:00 p.m. (CEST)

Japan: 9:00 a.m. to 5:00 p.m. (JST)

New York: 9:00 a.m. to 4:00 p.m. (EST)

Singapore: 9:00 a.m. to 2:00 p.m. (SGT)

South Korea: 10:00 a.m. to 2:00 p.m. (KST)

United Kingdom: 9:00 a.m. to 4:00 p.m. (GMT)

Forex Market Time Zone Converter

Trading Forex is a very time sensitive business. A mistake can mean lost money, so it is important to be as accurate as possible with your timing. Forex traders use time zones to make decisions about when to buy and sell currencies. Most trading platforms display the current time in Coordinated Universal Time (UTC) or Greenwich Mean Time (GMT). There are several different time zones in the world. In the Americas, Europe, Africa and many Asian countries, daylight Saving Time (DST) changes the clock time by an hour each year. This can create significant discrepancies in trading times between different regions. To account for these time differences, forex traders use a time zone converter to determine the local time. Most online forex platforms offer this function as part of their user interface. The time zone converter will show you the local time in the time zone you are in. This allows you to make smart trading decisions based on the local market conditions.

Forex trading can seem difficult, but with a little bit of know-how and some forex market time zone converter trading forex market session time in, you can start trading confidently and make some serious profits. It’s important to keep in mind the forex market time zone converter trading forex market session time in when trading forex. This allows you to better understand the local market conditions and make intelligent trading decisions. There are three main time zones in the world: the Americas, Europe and Asia. Forex trading is done in hours based on these time zones. The forex market time zone converter trading forex market session time in is GMT -08:00. This is the time zone used in North America, South America, the Caribbean, Central America and most of the Middle East. The forex market time zone converter trading forex market session time in is GMT -05:00. This is the time zone used in Europe, the UK, Ireland, Australia, New Zealand, most of Japan and South Korea. The forex market time zone converter trading forex market session time in is GMT -03:00

. Forex market time zone converter trading forex market session time is UTC +09:00.

Forex trading is a global business with millions of participants. Currency rates are constantly fluctuating and can vary significantly between different time zones. In order to make the most efficient and successful trading decisions, it is important to know the time zone in which the market is taking place. The forex market time zone converter trading forex market session time is UTC +09:00. This means that forex trading sessions in most markets are conducted in GMT -03:00. This means that, for those in the eastern hemisphere, forex trading sessions begin at 03:00 GMT, while those in the western hemisphere start at 09:00 GMT. This time zone conversion can be difficult for some traders to adjust to, as it often clashes with their normal daily routine. For those with a preference for working at a fixed schedule, it may be challenging to continue with forex trading during daylight hours. Fortunately, there are means by which traders can arrange their trading sessions to accommodate for the time zone conversion. One popular solution is to use a forex market time zone converter. These tools allow traders to easily adjust their time zone, allowing them to continue trading in their

respective time zones, regardless of daylight saving time changes. Forex market time zone converters allow traders to easily adjust their time zone, allowing them to continuetheir trading in their respective time zones, regardless of daylight saving time changes. By first identifying your time zone and inputting it into the converter, you can ensure that you are trading in your local time zone. Converters also allow for traders to view worldwide forex market hours in one consolidated window. This makes it easy to keep tabs on global market conditions even when you are not in front of your computer.

Trading forex markets on a global scale can be challenging, no matter what time zone you are in. This is because stock and Forex markets are open in different parts of the world at different times. To make trading Forex easier, it is important to have an understanding of the market session time tabs. This will help you determine when the best time to buy or sell is regardless of where you are in the world. The Global Forex Market Session Time Tab The global Forex market session time tab is one of the most important tools for Forex traders. This tab displays stock and Forex market conditions in different time zones around the world. The tab is divided into two parts: The first part is called the “Regular Session.” This part of the tab displays stock and Forex market conditions in all time zones. The second part of the tab is called the “Short Session.” This part of the tab displays stock and Forex market conditions in the time zone where the forex broker is located. For example, the “Regular Session” is displayed in all time zones, while the “Short Session” is displayed

in only a few time zones. Do forex traders need to know the difference between the “Regular Session” and the “Short Session”? No, forex traders don’t need to know the difference between the “Regular Session” and the “Short Session”. The “Regular Session” is displayed in all time zones, while the “Short Session” is displayed in only a few time zones.

In the Forex market “time healing powers” are shown very often. For reasons unknown traders from different time zones have problems synchronizing their work with the market. Here you will find a zone converter that will help you. The Forex market operates in 24 time zones around the world. This is why it can be difficult for traders from different time zones to synchronize their work with the market. Traders who live in the Eastern and Pacific Time Zones, for example, often have to adjust their work schedules to account for the fact that the market is open in the morning in Europe and the Middle East, and in the late afternoon in the United States. To make things even more difficult, some forex markets display the “Short Session” (the time during which trading is allowed) in a few time zones, while the “Long Session” (the time during which the market is open for trading) is displayed in all time zones. This can create even more confusion for traders from different time zones, who may not be aware that the market is closed in their time zone while it is open in another time zone. To make life even more difficult, fore

x market time zone converter trading forex market session time zone different countries use different time zones. As a forex trader, you need to be aware of the time difference between your home country and the forex market location. This time difference can impact the trading sessions you participate in, as well as the amount of money you make. In this article, we will provide you with a forex market time zone converter that will make life a little bit easier. By knowing what time zone the forex market is in, you can plan your day accordingly. The forex market can be open in either the GMT or EST time zone. This means that you need to be aware of the time difference between your home country and the forex market location. If the forex market is in the GMT time zone, then the time difference issix hours. If the forex market is in the EST time zone, then the time difference is nine hours. It is important to remember to convert the time in your home country to the forex market time zone before you start trading. This will ensure that you are participating in the correct trading session.

It is important to know the forex market session time in order to trade forex with precision. The forex market session time is a key piece of information to keep track of when trading forex. Forex trading is a complex and highly speculative market. This means that there is a lot ofamental action going on at the same time. In order to capitalize on the opportunities that are available, it is important to be aware of the forex market session time. The forex market session time is the time that the forex market opens and closes each day. This varies depending on the location, but usually it opens at UTC+00 and closes at UTC+03. This window is important because it determines the time frame in which forex can be traded. When trading forex, it is important to be aware of the different time zones. Forex traders in North America, Europe, and Asia often trade during different sessions. For example, North American traders typically trade during the morning session and European traders trade during the afternoon session. By knowing the forex market session time, traders can better plan their trading sessions. This will ensure that

they are taking advantage of the best opportunities and do not miss any key moves. To convert forex market session time to local time, traders can use a time zone converter. forex market session time: forex market session time, traders can better plan their trading sessions. This will ensure that they are taking advantage of the best opportunities and do not miss any key moves. To convert forex market session time to local time, traders can use a time zone converter. Forex market session time is a major consideration for traders when setting their forex trading plans. By understanding the forex market session time zone, traders can better plan their trading sessions to take advantage of the best opportunities and avoid missed opportunities. There are twenty-four forex market sessions each day, each lasting around eighteen hours. Each session starts at 4:00pm GMT and ends at 2:00am GMT the next day. This means that forex market session time is different across different parts of the world. To convert forex market session time to local time, traders can use a time zone converter. There are many online forex market time zone converters available, or

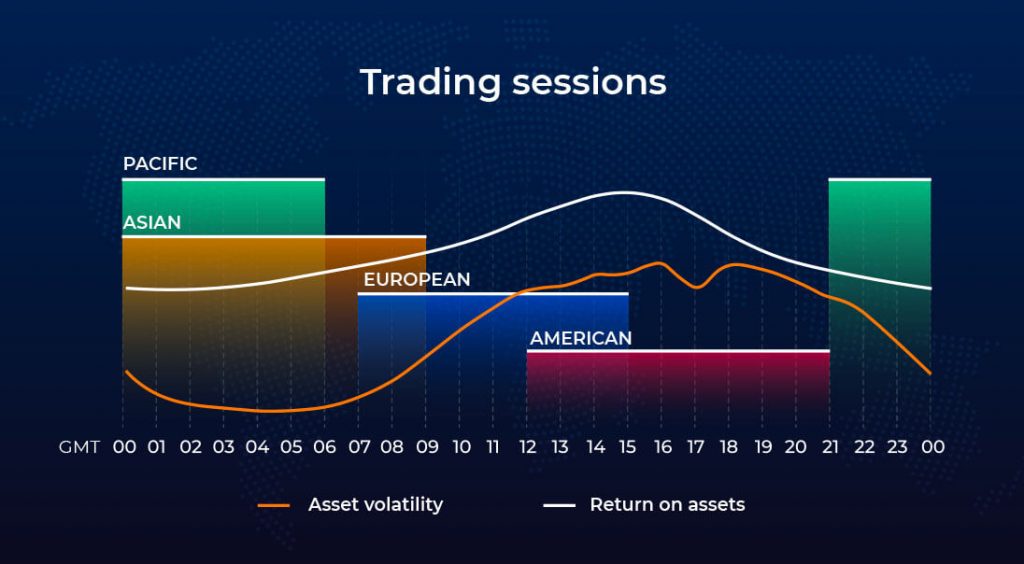

you can use an offline converter such as those that come with your smartphone. In this article, we will show you how to use a time zone converter to help forex traders plan their forex market sessions in a more accurate manner. First, it is important to understand that most forex market sessions take place in the morning in most forex markets around the world. In North America, Europe, and a number of other regions, forex markets open in the early morning and close in the late evening. The late evening trading sessions are usually dominated by Asian and Latin American markets, which open in the late evening and stay open until the early morning. To make the most efficient use of forex market time zone conversion, it is important to understand the concept of forex market session time. A forex market session is a continuous trading period that starts at the opening of the market and ends when the last trade is executed. In order to avoid unnecessary losses and maximize profits, forex traders should plan their forex market sessions in a way that takes into account the concept of forex market session time. The forex market session time concept is based on the time

zone concept. Forex market session time refers to the time of day during which the forex market is open for business.Daytime trading is usually active from 9 a.m. to 5 p.m. GMT. European forex market sessions are usually shorter, running from 9:30 a.m. to 4 p.m. GMT. Asian sessions are usually longer, usually starting at 10 a.m. and lasting until about 2 p.m. GMT. The U.S. sessions are the longest, running from 9:30 a.m. to 4:30 p.m. EST

There are many different factors that contribute to a successful trading session, but one of the most important is time. Many forex traders refer to trading sessions as trading “windows.” The time of day that you trade is as important as the strategy you use. Some people believe that there are specific times of the day when the market is more open to trading. This is based on the theory that the markets are more liquid and prices are more freely moving at certain times of the day. Other traders believe that all times of the day are good times to trade. Regardless of the theory, there are many important factors to consider when trading: 1. YOUR TIMEZONE If you are in a different time zone, make sure you adjust your trading times accordingly. You will likely make more mistakes if you are trying to trade while tired or while the market is closed in your time zone. 2. THE GAME DAY SESSION Traders who are in the “Game Day” session often have the best results. This is typically the time when people are most active and emotional. 3. THE WEEKEND

BEFORE A SWEEP The weekend before a major stock market manipulation is typically the time when most manipulations are planned.4. THE WEEKEND AFTER A SWEEP The weekend after a stock market manipulation is typically the time when most investors realize they have been defrauded.5. DURING THE DAYS AFTER A SWEEP The days following a stock market manipulation are typically when the damage is done.

Manipulated stocks tend to start falling early in the day. They fall faster and farther than stocks that are not being manipulated. The volume of the stock’s trade is also usually higher in the manipulated stocks. These behaviors suggest that traders are trying to support or sell the stock before it falls. Manipulated stocks usually fall faster and farther than stocks that are not being manipulated. So be prepared to trade with this knowledge in mind. 1:30 p.m. This is typically the busiest time of the day in the forex market. Many traders are trying to make some profits before the day ends. This is also the time when many traders are trying to sell their positions in the market. 8:30 p.m. This is typically the time when the forex market is closing. This is also the time when the forex market is the most stable. Many traders will want to exit their positions in the market at this point.

When trading forex, it is important to understand the concept of a trading session. A trading session is a defined period of time during which you will open and trade positions. A trading session can be defined in terms of number of trading hours or minutes. A trading session is also generally considered to be stable when the underlying currency or instrument is not unexpectedly affected by significant external events. When a trading session is stable, it will generally stay that way for the duration of the session. While a trading session can be considered stable, it is still important to be aware of the potential for unforeseen events to occur. In fact, one of the goals of trading is to capitalize on opportunities that may arise due to unforeseen events. By doing so, you can ensure that your overall trading strategy is resilient to unexpected outcomes.