Forex Risk Management Strategies

Trading forex is a high risk business. Therefore, risk management strategies are crucial to minimizing losses. This article will discuss several risk management strategies for those new to the forex market. Stop Losses One of the most important risk management techniques is setting stop losses. A stop loss is a predetermined price at which you will stop trading a pattern. When a trade reaches this price, you are automatically stopped out of the trade. This is a way to protect yourself from losing money in a trade. Set stop losses based on your risk tolerance and the nature of the pattern. For example, if you are trading a pattern that has a high probability of failing, such as a technical analysis pattern, set a higher stop loss. On the other hand, if you are trading a market trend, a lower stop loss will be more appropriate. If the trade reaches your stop loss, consider either taking the trade or selling the pattern at the stop loss point. If you wait to take the trade until the pattern has completed its course, you could risk loosing money if the trade does not work out. Profit Targets Another important risk management technique

is setting a profit target. The idea is to put a limit on your losses so that you don’t swing too heavily in either direction without having a clear idea of when you’ll be able to get out of the trade. This isn’t possible for all trades, but it’s a good strategy to consider for long positions. For example, if you’re trading a stock and plan to hold it for at least six months, set a profit target of $10 per share. If the stock goes above $10, you’ll make money, but you’ll also protect yourself from selling at an unnecessarily high price. If the stock falls below $10, you can take a loss before getting out of the trade.The goal of risk management is to keep your losses as low as possible while still achieving your investment objectives. There are many different risk management techniques, and the most effective one for you will depend on your individual trading style and financial situation.

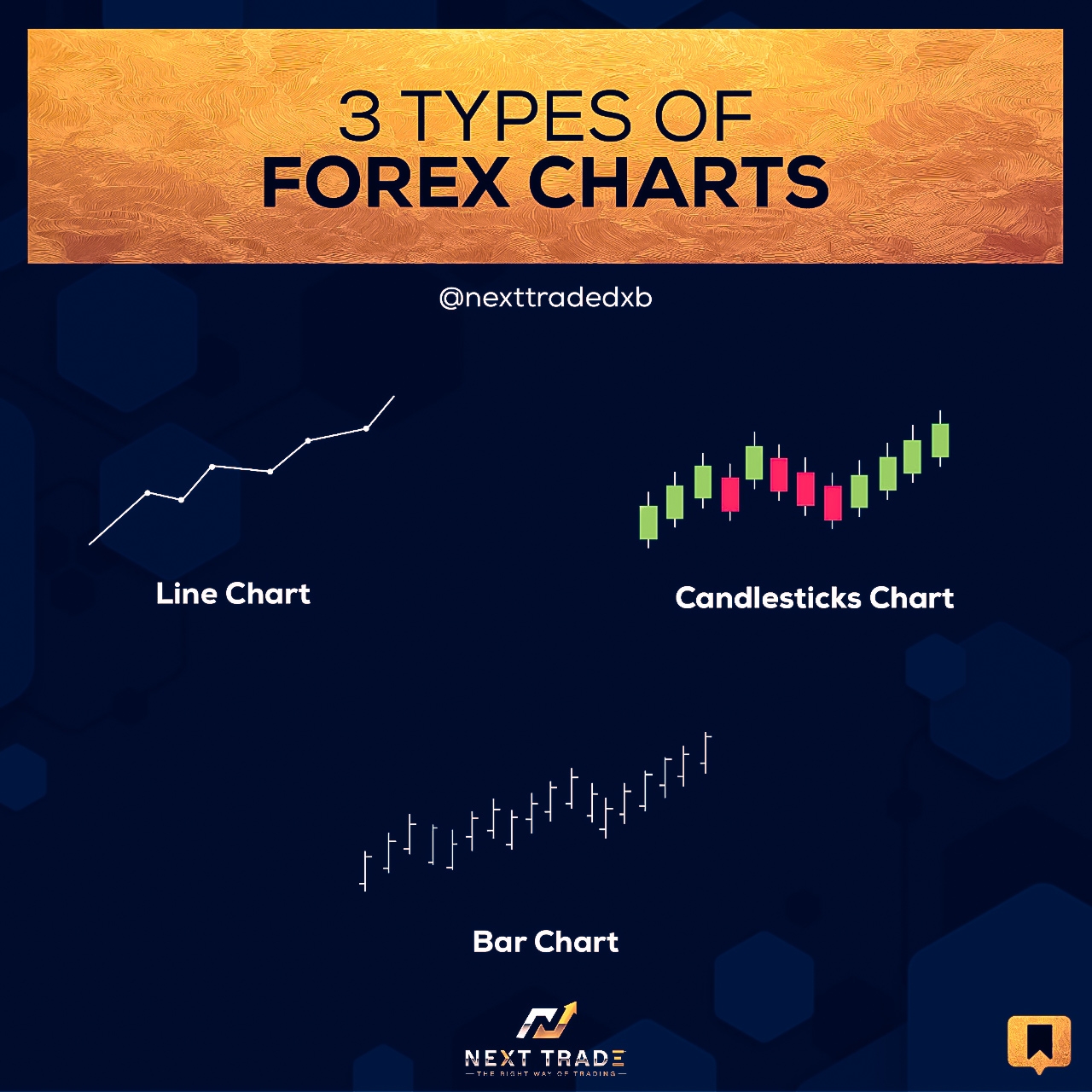

When trading forex, there is always the potential for large losses if you do not properly manage your risks. Here are some risk management strategies that are commonly used by forex traders. 1. Always have a trading plan Before you start trading, create a trading plan that details your intended trading strategy and the goals you hope to achieve. This will help you track your progress and avoid making unnecessary trades. 2. Use stop losses Whenever you make a trade, set a stop loss point that will trigger a sale of your position if the price falls below that point. This will help you reduce your risk if the market moves against you and stop you from losing all of your money. 3. Use a hedging strategy If you anticipate market movements that could hurt your position, you can use a hedging strategy to protect yourself. This involves buying and selling different types of assets to create a balance in your portfolio that counters the potential loss. 4. Use indicators and charts Charts and indicators can help you make better decisions when trading. use them to monitor your overall performance, to find patterns in the market, and to identify potential opportunities.

The Importance of Risk Management in Forex Trading A successful forex trading career requires mastery of risk management techniques. Many traders make the mistake of over-trading, which can lead to significant losses. It’s important to monitor your overall performance, to find patterns in the market, and to identify potential opportunities. The first step in risk management is understanding the risks associated with forex trading. There are three major types of risks: 1. Liquidity risk This refers to the risk of not being able to find a buyer or seller for your currency exchange rate. If the market is crowded, you may not be able to sell your currency at a desired price. 2. Systematic risk This refers to the risk of investing in a strategy that has a high chance of losing money. For example, you might trade with a system that favors certain commodities or currencies. If the market changes and those commodities or currencies become less volatile, your strategy could lose money. 3. Volatility risk This refers to the risk of prices changing rapidly and unpredictably. For example, you might buy a currency and then sell it immediately, which

increases your potential risk because you are gambling that the price will stay the same. This is why it is so important to develop a sound risk management strategy before you start trading. When you’re starting out in forex trading, it can be tempting to try every tactic under the sun in order to make quick profits. However, this approach is fraught with risk, and can quickly spiri t you out of a winning position. In this chapter, we’ll go over some of the most important risk management strategies for forex traders. Before You Begin Trading Before you start trading forex, it’s important to have a sound risk management strategy in place. One of the greatest risks in forex trading is the tendency for prices to move quickly and unpredictably. This means that you could find yourself in a situation where you’ve lost a lot of money because the market has moved against you unexpectedly. One way to reduce this risk is to take a long-term perspective when trading. This means trading with plans and expectations of what the market might do, instead of basing your decision solely on current trends.

There are a number of things you can do to manage your risk when trading Forex. Here are a few tips: 1. Understand the risks Before trading, it is important to understand the risks involved. This can be done by reading up on Forex trading theory, and understanding the important concepts such as leverage and margin trading. 2. Diversify your portfolio One of the most important things you can do to manage your risk is to diversify your portfolio. This means owning a variety of different currencies and commodities, so that you have a better chance of making a profitable trade. 3. Keep a close eye on your portfolio It is also important to keep a close eye on your portfolio, and stay informed about the market conditions. This will help you make informed decisions about when to take risks on future trades, and when to stay put. 4. Use stop losses Another way to protect yourself from losses is to use stop losses. This helps you to avoid going too deep into a trade, and potentially losing money. 5. Use indicators Another way to help protect your portfolio is to use indicators. These are software

programs that give traders clues about the market conditions and the best time to sell or buy. By using indicators, traders can reduce their risk of losing money and increase their chances of making a profit. The type of indicators that are available can vary, but most of them use historical data to help traders make informed decisions about when to sell and buy securities. Some indicators are specific to certain types of securities, such as stocks or commodities. Others, such as trend indicators, can be used with any asset. Many indicator programs have built-in stop losses. When a trader enters a trade, the program will set a predetermined price at which it will sell the security. If the price falls below the stop loss, the computer will sell the security. If the price rises above the stop loss, the computer will hold on to the security. A stop loss is an important safety net. If the price of a security falls below the stop loss, the trader has insured himself against a loss. If the security rises above the stop loss, the trader has guaranteed himself a profit. As with any trading strategy, there are risks associated with forex risk management. If a trader

enters into a trade without first assessing and. The Basics of Forex Trading. Forex trading is a risky proposition and the best way to minimize the risk is to find a forex broker with a tight margin. Risk management is one of the most important aspects of forex trading. Successfully managing risk will help you maintain profitability and avoid burnout.