European Forex Trading Session : London Forex Market Hours

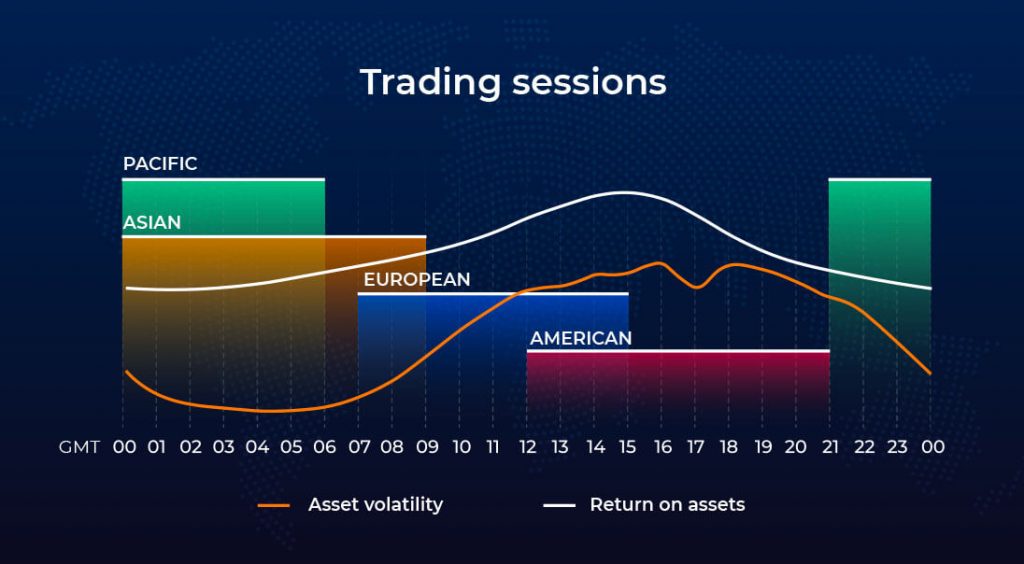

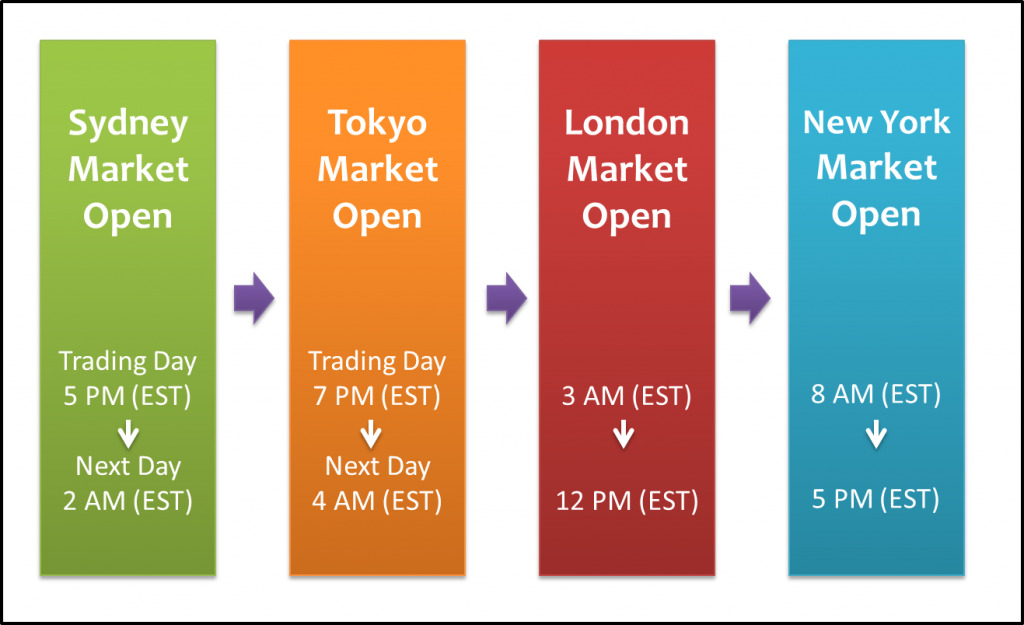

In the forex market, traders often times need to calculate the time it will take for their screens to update with market data. This time is known as the “session time.” When looking at the forex market, there are two main sessions that traders need to be aware of. These are the European session and the U.S. session. The European session runs from 7:00 a.m. to 2:00 p.m. GMT, and the U.S. session runs from 9:00 a.m. to 4:00 p.m. EST. When trying to determine the session time for the forex market, traders need to first consider the time it takes for data to flow from exchanges around the world. This can take a few seconds or minutes, but it is important to keep that in mind when making calculations. Then, traders need to factor in the time it takes for their computer to process that data. Forex traders need to be aware of the differences between Windows and Mac operating systems when it comes to this time. After that, traders need to consider the time it takes for their screen to refresh

. This is usually around 500 milliseconds but can be as slow as 1,000 milliseconds. Forex trading sessions usually last for around four hours. This is broken down into two parts: the pre-market and the market session. The pre-market session begins at 7am UK time and ends at 10am. This is the time when most forex traders are trading just to check the prices and see if there have been any big movements. The market session, on the other hand, begins at 10am and goes until 3pm. This is when the real trading takes place. Most forex traders try to trade during this time as it is when the market is busiest. However, it is important to remember that this is a volatile market and there are always chances of the prices opening or closing at a different time. So it is always a good idea to check the time zones before you start trading.

Traders from continental Europe generally trade during the morning session and from the US, traders often start the day by trading during the morning session. For most Japanese markets, the night session is the main trading day. However, when you trade the forex market, it is important to understand that the time zones may not be the same as where you live. So if you are from Europe and are trying to trade during the morning session in the US, you will be doing so at your own risk. If you are trading the forex market, you will need to understand how the time zones work in order to make the most efficient use of your time. Trading during different time periods can give you a significant advantage in the forex market. To trade during the morning session in the US, you will need to understand the central time of the US. The central time is the time that is set by the US government and is used as the reference time for all other time zones in the US. The central time is also the time that most forex traders use. If you are trade in Europe, you will need to understand the time zones in your country

The Forex market operates 24 hours a day, 7 days a week. The time zones in Europe differ from country to country, so you’ll need to understand your local time zones in order to trade during the European session. Trading during the European session can be challenging, but with a little preparation and foreknowledge of the time zones, you’ll be able to get the most out of your trading experience. Here’s a breakdown of the European session, and how to trade according to the time zones in your country: The European session starts at 3 p.m. GMT (London Time) on the first day of the month, and ends at 2 a.m. GMT the following morning. That means that traders in the UK, Austria, Germany, Switzerland, Denmark, Sweden, and Norway will trade during the European session, while traders in Italy and Spain will trade during the Latin American session. In order to trade during the European session, you’ll need to be aware of London time. London time is UTC+0, so the first day of the month in London is on the first day

of the month in Europe. Forex trading is a highly technical and complex market that can be difficult to follow. That’s why we’ve put together this guide to help you understand the forex markets and the different sessions in which they trade. The forex markets are open 24 hours a day, 7 days a week. They are based in London and trade in UTC+0. This means that the first day of the month in London is on the first day of the month in Europe. There are four sessions in which forex can be traded: the Asian session, the European session, the US session, and the London session. The Asian session is open from 6:00am to 9:30am BST. The European session is open from 9:30am to 12:00pm GMT. The US session is open from 2:00pm to 5:00pm EST. The London session is open from 8:30am to 11:00am GMT.

Trading in the forex market can be a very exciting experience, but it can also be very time consuming. There are a number of factors that can affect how the forex market operates, including the time of day that it opens and closes. One of the most important things to remember when trading the forex market is to pay attention to the session time open from 2:00pm to 5:00pm EST. This is the time frame during which the forex market is open for trading. By following this time frame, you will be able to optimize your trading strategy accordingly. Another important factor to keep in mind when trading the forex market is the GMT time frame. The London session is open from 8:30am to 11:00am GMT, while the Frankfurt session is open from 9:30am to 12:30pm CET. By following these time frames, you will be able to better understand how the forex markets operate in different parts of the world.

There are different session times in different parts of the world when it comes to the forex markets. In the European market, for example, session times are typically from 9am to 4pm. Meanwhile, the Japanese market operates from 9am to 5pm. This can make it difficult for traders to better understand how the forex markets operate in different parts of the world. By understanding the different session times, traders can better prepare for their trades. This can help them avoid missing opportunities or making incorrect decisions due to the time difference. Additionally, traders can use this information to their advantage. For example, if traders are trading in the European market, they may want to avoid making trades after 4pm. This is because the Japanese market closes at 5pm. Knowing the different session times can also help traders predict how the markets will move. For example, if traders know that the Japanese market will close at 5pm, they can forecast how the markets will move before the close of the market. This can help traders make the best trades possible. Overall, understanding the different session times can help traders make better decisions when trading the forex markets.

When trading in the forex markets, it is important to be aware of the different session times. Trading during different session times can help traders make better decisions when trading the forex markets. The forex markets are open 24 hours a day, 7 days a week. However, the sessions on the forex markets differ based on the time of day. In the morning session, the forex markets are open from 6:00 a.m. to 9:00 a.m. In the afternoon session, the forex markets are open from 12:00 p.m. to 3:00 p.m. The evening session is from 6:00 p.m. to 9:00 p.m. The night session is from 10:00 p.m. to 4:00 a.m. The forex markets are closed on weekends. After trading on the forex markets for a while, you will likely want to be aware of the different session times so that you can make better decisions when trading.

Forex traders who are looking to capitalize on opportunities during the morning and after-noon session are likely to be disappointed, according to a recent study. The study, conducted by Swiss financial services provider UBS, found that the morning and after-noon sessions are by far the least effective times to trade the forex market. Why is this? The morning and after-noon session times are typically slower than the afternoon and morning, making it more difficult to make quick decisions. This can lead to erroneous trades and diminished profits. Instead, UBS recommends forex traders focus their efforts during the morning and evening session times. This is because these sessions are typically faster-paced and offer more opportunities to make profitable trades. It’s also important to be aware of the different session times in order to make the best decisions when trading. The forex market operates on a 24-hour “session” basis. This means that, no matter what time of day it is, the forex market is open for trading and provides the same opportunities for profits. There are three different session times during which the

forex market is open: early, morning, and afternoon. The forex market opens at 4pm GMT and closes at 2am GMT the next day. During this time, traders have three sessions in which to trade: early, morning, and afternoon. The early session usually lasts from 4pm to 6pm GMT, the morning session from 7am to 9am GMT, and the afternoon session from 2pm to 4pm GMT. Each session offers different opportunities for profits. The early session is the best time to trade if you want to make the most profits, while the afternoon session offers the least opportunity for profits. The forex market is open 24 hours a day, so you can always try to make trades during the morning or afternoon sessions. However, because the forex market is smaller during these times, the risks are also higher. You should always do your research before trading in the forex market to make sure you are making the right decisions.

Forex trading can be very profitable, but like any other investment, it is important to take the time to research the market and make the right decisions. There are a few things you can do to make sure you are making the right choices before trading: 1. Get a good forex trading plan: A solid forex trading plan will help you stay disciplined and make wise decisions. 2. Get familiar with the forex markets: It is important to be familiar with the different forex markets and their trading patterns. 3. conduct thorough research: Always do your own research before investing in forex or any other financial product. 4. stay disciplined: Do not take unnecessary risks when trading forex. Be Patient and Stick to Your Trading Strategy.

Trading forex is a highly technical and complex activity. Therefore, it is important to take the time to understand all the principles involved in order to ensure that your trades are successful. One of the most important principles to follow is the “rule of thumb”. This is the old saying that goes “time is on your side” and it is true when trading forex. By being patient and sticking to your trading strategy, you can limit the amount of risk that you take on each trade. Another important principle to follow is to “stay in the trade”. This means that you should not jump out of a trade if the initial price action is not in your favour. If you do this, you will likely end up taking unnecessary risks, which could lead to a loss of money. Finally, it is also important to be disciplined. When you first start trading forex, you may be tempted to make overly large trades quickly. However, this is not advisable and will almost certainly lead to a loss of money. Wait until the market has had a chance to properly price the trade before making a decision.

What is the best currency pairs to trade in the London session? There is no definitive answer to this question since it depends on the trader’s individual strategy and preferences. However, some popular currency pairs to trade in the London session include the US Dollar (USD), the Euro (EUR), the British Pound (GBP), the Japanese Yen (JPY), and the Canadian Dollar (CAD).

What are the best currency pairs to trade in the London Forex market? The best currency pairs to trade in the London Forex market are the Euro (EUR), the British Pound (GBP), the Japanese Yen (JPY), and the Canadian Dollar (CAD). Euro (EUR) The Euro is the most popular currency in the London Forex market and is generally considered to be a safe investment. Because the Euro is the currency of many European countries, it is often used to trade internationally. British Pound (GBP) The British Pound is the third most popular currency in the London Forex market and is often used to trade internationally. Because the British Pound is a recognized currency, it is less volatile than some of the other currencies. Japanese Yen (JPY) The Japanese Yen is the fourth most popular currency in the London Forex market and is often used to trade internationally. Because the Japanese Yen is a recognized currency, it is less volatile than some of the other currencies. Canadian Dollar (CAD) The Canadian Dollar is the fifth most popular currency in the London Forex market and is

also the fifth most traded currency in the world market. In the Forex market, the Canadian Dollar is traded against the British Pound, Euro, Yen, and the US Dollar. This is due to the country’s high economic stability and its trade ties with the major economies in the world. Canadian Dollar is also one of the most popular Forex currencies for day trading. Some of the key reasons why Canadian Dollar is a popular currency to trade include the following: It is a regional currency The Canadian Dollar is the fifth most popular currency in the London Forex market and is also the fifth most traded currency in the world market. In the Forex market, the Canadian Dollar is traded against the British Pound, Euro, Yen, and the US Dollar. This is due to the country’s high economic stability and its trade ties with the major economies in the world. Canadian Dollar is also one of the most popular Forex currencies for day trading. Some of the key reasons why Canadian Dollar is a popular currency to trade include the following: It is a regional currency In terms of liquidity , Canadian Dollar is one of the most traded currencies in the world , Canadian Dollar is one of the most

popular. When is the best time to trade currencies? The best time to trade currencies is typically during market sessions when the markets are open. However, this time can vary depending on the currency pair and market conditions.

What is the best currency pair to trade London session session trading forex market session time are open? This is a difficult question to answer as it depends on the currency pair and market conditions. However, some popular currency pairs to trade during the London session session trading forex market session time are the GBP/USD, EUR/USD, and JPY/USD.

What is the London Session Session Trading Forex Market Session Time? The London Session Session Trading Forex Market Session Time is the time of day when the markets are open in London, England. This is the time when forex traders from around the world come to trade markets in the British pound, euro, and Japanese yen.

So you want to trade currencies? Great! Here are some FAQs to answer: -What are the best currency pairs to trade? There is no one-size-fits-all answer to this question. Every trader has different preferences and needs, which is why there are so many different currency pairs to trade. That said, some popular currency pairs include the British pound sterling, the euro, the Japanese yen, and the US dollar. -What time of day is best to trade currencies? This is a difficult question to answer. It depends on your own trading style and schedule. Some traders prefer to trade during evening or nighttime hours, while others prefer to trade during the day. It’s important to find a trading schedule that works for you. -How long should I trade currencies for? Again, this is a question that depends on your own trading style and schedule. Some traders manage their positions for a few hours, while others hold their positions for days or weeks. It’s important to find a trading schedule that works for you.

Looking to trade in the London session? Here are some best currency pairs to trade during this time: USD/EUR: This is a popular pair to trade during the London session, as it is generally considered to be a safe pair to trade. This is because the Euro is a strong currency, and therefore, the value of the USD/EUR pair is stable. GBP/USD: The GBP/USD pair is also a popular currency pair to trade during the London session. This is because, as the GBP is a strong currency, the value of the GBP/USD pair is also stable. JPY/USD: The JPY/USD pair is a popular currency pair to trade during the London session, as it is generally considered to be a medium-term pair. This is because, as the JPY is a weaker currency, the value of the JPY/USD pair is generally volatile.

Looking for a currency pair to trade in the London session? The JPY is a weaker currency, and the value of the JPY/USD pair is generally volatile.

Therefore, it is not a good choice for long-term forex trading. The euro (EUR/USD) pair is a better choice for forex trading because its value is relatively stable. The AUD/USD pair is also a good choice for trading because it is a relatively strong currency.

Many forex traders consider the euro as a strong currency, which means that it provides good opportunities for profitable trades. In the London session, the euro is generally stronger against the U.S. dollar. Consequently, it is a good choice for trades in the euro/dollar exchange rate. Another strong currency option in the London session is the British pound. In general, the pound is stronger against the U.S. dollar and the euro. Consequently, it can be a good choice for trades in the GBP/USD and GBP/EUR exchange rates. Other currencies that can be good trades in the London session include the Japanese yen and the Swiss franc. The yen is generally weaker against the euro and the U.S. dollar, while the franc is relatively strong against both currencies. Combined, these currencies give traders good opportunities to make profits in the EUR/JPY and EUR/CHF exchange rates.

Looking for a currency pair to trade in the London session trading forex market session time currencies? You’re in luck! These two currencies offer good opportunities to make profits. The EUR/JPY currency pair is a great option for traders who are looking to make a profit in the direction of Yen strength. This pair is currently trading at 102.15 yen, which is a level that is below the 100 yen level but above the 97.50 yen level. This indicates that the market is hopeful that the Yen will weaken further, which could lead to profits for those who are trading in this currency pair. Meanwhile, the EUR/CHF currency pair is a good option for traders who are looking to make a profit in the direction of the Swiss Franc. This currency pair is currently trading at 1.31 Swiss Francs, which is above the 1.25 Swiss Franc level but below the 1.35 Swiss Franc level. This indicates that the market is hopeful that the Franc will strengthen further, which could lead to profits for those who are trading in this currency pair.

In the forex market, there are many currency pairs that can be traded. However, some currency pairs are more volatile than others, and can lead to greater profits if traded correctly. The euro/sterling currency pairing is a good example of a volatile currency pair that can lead to greater profits. This currency pair is typically more volatile than other currency pairs, and is therefore more likely to move in either direction. This means that if you are trading in this currency pair, you will need to be prepared to quickly react to changes in the currency’s value. This combination of volatility and potential for large gains makes this currency pair a good choice for those looking for a high-profit trading opportunity. If you are able to correctly predict when the currency prices are going to change, you can earn significant profits. While this currency pair is certainly not for everyone, those with the necessary trading skills will be able to reap the benefits. If you are looking to trade in the euro/sterling currency pair, be sure to research the market and carefully select a broker with the appropriate technical analysis tools. This will help you to make more informed decisions when trading.