Asian Forex Trading Session : Tokyo Forex Market Hours

Asian forex session (Tokyo) Trading Forex Market Session Time

Tokyo Forex Session: The Tokyo Forex session runs from 9:00am to 7:00pm Japanese Standard Time. The Japanese yen is the primary currency traded in the Tokyo Forex market. Forex traders in Tokyo should expect volatile trading conditions throughout the day as market conditions fluctuate quickly.

The forex market session time in Tokyo is 10:30am to 3:00pm JST. However, it is advised to check the latest market conditions before trading.

Please note that some Asian currencies are not always quoted in English. While all foreign exchange rates are displayed in Japanese Yen (JPY), please be aware that the exchange rate between Japanese Yen and other currencies may differ from the displayed rate. Tips for Trading Forex When trading forex, it is important to keep a close eye on the market conditions. There are a variety of indicators that can be used to help make trading decisions, so it is important to be familiar with what they all look like. Some of the most common forex indicators include the supply and demand levels, volume indicators, and trendlines. It is also important to be familiar with candlestick charts, as they can be a useful tool for tracking changing market conditions. For those who are new to forex trading, it is always advisable to consult with a professional before making any serious investments.

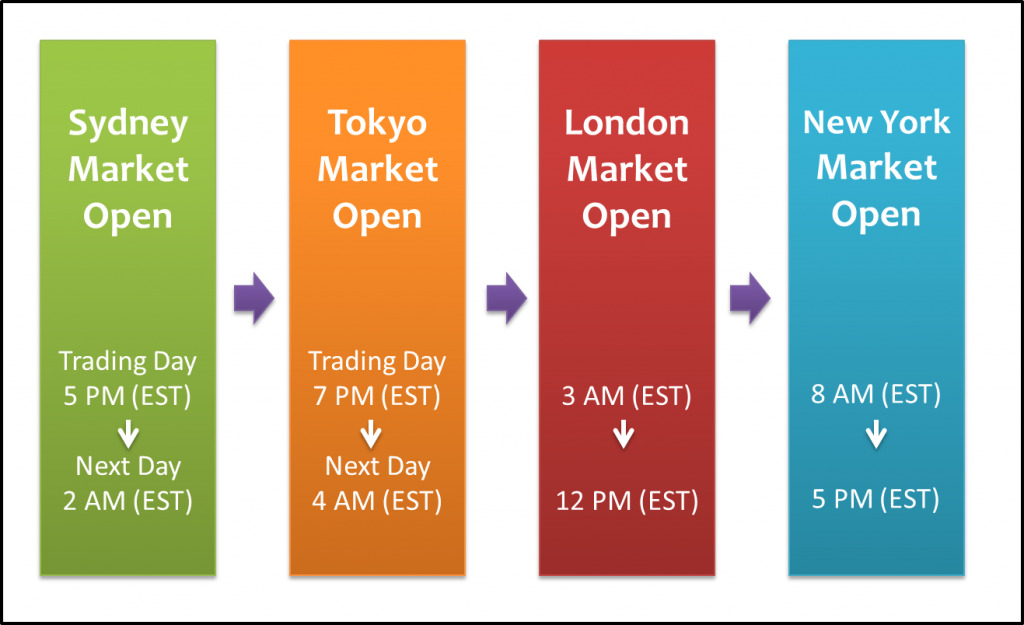

Forex trading can be a very profitable business, but as with any investment, it is important to do your homework. A professional Forex trading coach can provide guidance and sound advice on the best trading strategies to use in order to attain consistent profits. The Forex market opens at 5 p.m. UTC in Tokyo (9 a.m. EST) each day. This is followed by the U.S. market, which opens at 9 a.m. EST and the European market, which opens at 11 a.m. CET. The Tokyo market is closed on Sundays. The Forex market in Tokyo is divided into two sessions – the morning session and the afternoon session. The morning session runs from 9 a.m. to 11 a.m. whereas the afternoon session runs from 1 p.m. to 4 p.m. As with any investment, it is wise to seek professional investment counseling before making any Forex trade. A Forex trading coach can provide you with sound advice on the best Forex trading strategies to use in order to make consistent profits.

If you’ve ever wanted to make some serious money in the Forex market, you know that it can be a complex and rewarding experience. That said, there are a few basic tenets that will help you trade smarter and achieve higher profitability. In this article, we will cover the best Forex trading strategies and give you some pointers on when to use them to maximize your profits. Before we get started, it’s important to understand the Forex market and its various constituent parts. The Forex market is a large and complex international currency market. It contains more than 7,000 currencies and trades in hundreds of millions of transactions each day. This broad exposure to a variety of currencies makes the Forex market a great place to invest. However, it is also a potentially dangerous place, as it contains a high degree of speculation. As a Forex trader, you need to be able to read the market and determine when to buy and sell currencies. There are a few basic tenets that you need to remember if you want to make consistent profits in the Forex market. 1) Buy low and sell high This

is not difficult to learn but very hard to do successfully. Asian Forex Session (Tokyo) Trading forex can be a very profitable venture, but it is not for the faint of heart. The forex market is a highly volatile market, and it is important to have a clear understanding of how it works in order to make consistent profits. To trade forex successfully, you need to buy low and sell high. This is not difficult to do, but it is very hard to do consistently. The forex market is highly sensitive to news and events, and it can quickly change direction. If you are not able to stay flexible and adjust your trading strategies quickly, you will likely lose money. It is also important to have a sense of timing. The forex market is open 24 hours a day, and it is constantly moving. If you try to trade during the middle of the night, you will likely lose money. You need to be patient and wait for the right moments to trade. If you are serious about making consistent profits in the forex market, then you should learn as much as you can about it.

The Tokyo Session Trending Forex Market Session Time The Tokyo Session is comprised of order flow in Japanese yen against the U.S. dollar. The session began at 10:00 a.m. GMT and is scheduled to end at 4:00 p.m. GMT. The following are three factors to consider when trading in the Tokyo Session. First, consider the political news in Japan. Significant political events may affect the value of the yen against the U.S. dollar. For example, the Japanese Prime Minister’s promise on December 3 to hold a referendum on Emperor Akihito’s future has increased uncertainty in the Japanese financial markets. Second, consider the economic data released by the Japanese government. Economic indicators released by the Japanese government can impact the value of the yen against the U.S. dollar. For example, Tokyo Industrial Production data released by the Ministry of Economy, Trade and Industry can affect the value of the yen against the U.S. dollar. Third, consider the global economic conditions. Global economic conditions can impact the value of the yen against the U.S. dollar. For example, global political

events may cause the Japanese yen to surge or fall in value against the U.S. dollar. In the Tokyo session trading forex market, session time can impact the value of the yen against the U.S. dollar. For example, global political events may cause the Japanese yen to surge or fall in value against the U.S. dollar. Session time also affects the value of other pairings, such as the Australian dollar and the British pound. As of February 17, 2019, the yen was worth 121.93 U.S. cents. This means that if someone wanted to purchase $100 worth of yen, they would need to Send $121.93 to a forex dealer in order to receive the yen.

Hello, traders! If you’re looking to trade the Tokyo session, you’ll need to send $121.93 to a forex dealer in order to receive the yen. That’s a pretty hefty transaction fee, but it’s worth it to get in on the action early. The Tokyo session has a 6:00 PM close, so you’ll have just about four hours to make your trade. Bear in mind that the market can move pretty quickly, so be prepared to act fast if you want to make a profit.

Tokyo Session Trading Forex Market Session Time The Tokyo session trading forex market session time is pretty quick, so be prepared to act fast if you want to make a profit. There are a few things you need to keep in mind when trading during the Tokyo session. 1. The Tokyo session trading forex market session time is short, so you need to be prepared to trade quickly. 2. The Tokyo session trading forex market session time is volatile, so you need to be prepared for sudden movements. 3. The Tokyo session trading forex market session time is crowded, so you need to be prepared for a lot of noise. The good news is that with a little preparation and some luck, you can make a lot of money trading in the Tokyo session. If you want to learn more about trading in the Tokyo session, be sure to check out our online resources.

The Tokyo session is the biggest and most active session in the forex market. This is where many of the major currency pairs are traded. The main reason why the Tokyo session is so important is because it is when the major financial markets in the world are open. This means that investors from around the world are able to trade Forex. This also means that there are a lot of opportunities for profitable trading. If you are able to get in on the action during the Tokyo session, you are likely to be able to make some big profits. Another reason why the Tokyo session is important is because it is considered to be the home of the Yen. This is because many large financial institutions in Japan are based there. So, the Tokyo session is a key venue for trading Japanese Yen. So, if you are looking to invest in Japanese Yen, the Tokyo session is where you need to be. However, it is important to be aware of the risks associated with trading in the Tokyo session. One of the main risks is that the market can move quickly and unpredictably. This means that you can easily get caught up in the action and lose

track of what you are doing. The Tokyo Forex Market can be a very fast-paced and thrilling experience. A common mistake people make when trading in the Tokyo Forex Market is getting carried away with the action. This means that they can easily get lost in the excitement of the market and forget what they are doing. This can quickly lead to losses and can be extremely difficult to recover from. It is important to remember that the Tokyo Forex Market can be a very fast-paced and thrilling experience. This means that you should take things slow and be aware of your surroundings. This way, you will be able to stay focused on the task at hand and won’t get caught up in the excitement of the market.

Traders who only trade during the Tokyo session may find themselves at a disadvantage. This is because the Japanese market opens at 9:00am and shuts down at 5:00pm, which is two hours shorter than the American market. This means that the opportunities for buying and selling are limited during the Tokyo session. If you want to trade forex, you’ll need to be comfortable with trading during all hours of the day. This is especially true if you want to make effective use of leverage. leverage is a powerful tool that can help you make money trading forex. However, it’s important to be aware of the risks involved. If you use too much leverage, you could end up losing all your money. Don’t get too caught up in the excitement of the market. If you don’t have the time to trade during the Tokyo session, use it to study the market trends and patterns. This will help you to better understand which assets and currencies are worth investing in.

Characteristics

Tokyo/Asian Trading Session: Trading Forex Markets Session Time With the holiday season upon us, many traders will be taking a break from the markets. However, some traders may still be active, as the trading session time in Tokyo and many other Asian markets tend to run much later than in most other markets around the world. Traders in the Tokyo/Asian trading session generally trade for much longer periods of time than in other markets around the world. This has a lot to do with the fact that Japanese and other Asian markets are much more orderly and dependable than most other markets. As a result, traders in these markets are generally more comfortable holding positions for longer periods of time. In contrast, traders in most other markets around the world are typically much more aggressive and tend to sell or trade positions more often. This is because traders in more aggressive markets tend to believe that they can find better bargains or opportunities faster than they can in more orderly markets. As a result, traders in more aggressive markets often trade for shorter periods of time. This difference in trading style can often lead to different results for traders in different markets. For example, traders

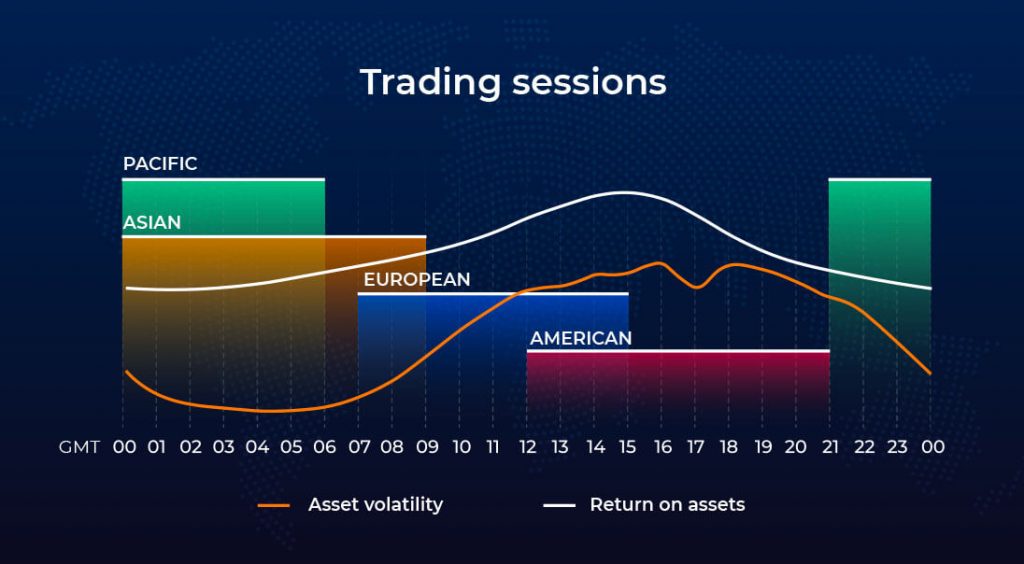

in Tokyo who trade during the morning session may see different results than traders in London trading during the afternoon session. The trading style of a market player can often lead to different results in different markets. For example, traders in Tokyo who trade during the morning session may see different results than traders in London trading during the afternoon session. A look at the Tokyo/Asian trading session shows the following: The Tokyo/Asian trading session starts at 8:00am GMT and ends at 4:00pm GMT. During this time, traders in Tokyo are more likely to make decisions based on price action as the volume is lower. This is due to the fact that many people in Tokyo are working during this time and are not available to trade as much. As a result, the market in Tokyo is more volatile and moves more rapidly. In contrast, the London trading session starts at 3:00pm GMT and ends at 11:00pm GMT. During this time, traders in London are more likely to make decisions based on fundamentals. This is due to the fact that many people in London are not available to trade during the morning and lunchtime sessions as they are working. As a

trader, if you wish to trade during these windows, it is important to understand how the Tokyo/Asian trading session works. For most of the world, Monday is typically a workday. However, for traders in the Tokyo/Asian trading session, Monday is their day to trade the stock and currency markets. This trading session runs from 9:00am to 1:00pm Japanese Standard Time, and from 12:30pm to 3:30pm GMT. This is because in Japan, it is customary for offices to close for lunch at 1:00pm. This gives Japanese stock and currency traders plenty of time to work on their trades before the markets close for the day at 3:30pm. In addition, the Tokyo/Asian trading session is usually quite busy. This is because most of the world’s financial markets are open during this window, and many traders want to take advantage of these conditions. So if you want to trade the Tokyo/Asian trading session, make sure you are available to trade during these windows. And remember, because this session is so busy, it is often difficult to find decent trading conditions. So if you are looking to

trade Forex and find the conditions difficult or almost impossible to find, you are not alone. One of the reasons is the time it takes for the Tokyo/Asian session to finish. A session is traditionally defined as a period of time starting at midnight and ending at the same hour the next day. But in the Forex market, the Tokyo/Asian session can last anywhere from six to eight hours. This means that if you are looking to trade during the day, you will have to fight against the clock in order to find decent conditions. Moreover, the Tokyo/Asian session is often the busiest and most volatile of the day. So if you are looking for a guaranteed way to make money, you are likely to be disappointed. However, if you are prepared to trade in difficult conditions, the Tokyo/Asian session can be a great place to start. Here are five reasons why the Tokyo/Asian trading session is a great place to start your Forex trading career: 1. Buy/sell opportunities are plentiful. 2. The Tokyo/Asian session is often the busiest and most volatile of the day. 3. The Tokyo/Asian session is often the source of

the busiest and most volatile of day’s on the forex market. When it comes to the busiest hour for the forex market, the Tokyo/Asian session is always a hot spot. This is because a large percentage of all trading activity takes place during this time frame. Plus, the volatility of the markets ñ both up and down ñ is often disproportionately high during this timeframe. Another reason why the Tokyo/Asian session is so active is that it typically follows the U.S. session in terms of market volume. This means that a lot of investorsÆ money is flowing around the world during these two hours. And because the Tokyo/Asian markets are much smaller than those in the United States, individual trades can have a much greater impact. Overall, the Tokyo/Asian session is a high-volume, high-volatility environment. So if you’re looking for action, this is the time to be on the lookout.

There are many currency pairs to trade and manyForex brokers to choose from. However, some of the most profitable currency pairs to trade are the ones that are in high demand and have pronounced trends. Today, we will focus on some of the most profitable currency pairs to trade in the Asia session. 1. The USD/JPY currency pair is one of the most popular currency pairs in the Asia session. The USD/JPY currency pair is a good example of a pair with a pronounced trend. The USD/JPY has been trading in a loop, which can be defined as a series of up and down cycles. The USD/JPY currency pair is also in high demand, which means that there is a lot of interest in this currency pair. 2. The EUR/JPY currency pair is also a popular currency pair in the Asia session. The EUR/JPY currency pair is also in high demand and has a pronounced trend. The EUR/JPY currency pair is also in good supply, which means that there is not a lot of demand for this currency pair.

Forex traders who want to trade the AUD/JPY should consider when to trade and what type of indicator to use. The AUD/JPY is a currency pair that traders may want to consider when trading in the Asia session trading forex market. The currency pair typically does not have a lot of demand, meaning that there is not a lot of demand for this currency pair. This means that when traders want to trade the AUD/JPY, they should consider when to trade and what type of indicator to use. Some traders may want to trade the AUD/JPY when the market is in a downtrend. When trading in this type of market, traders may want to use a buy indicator to help them identify when the market is in a good buying opportunity. On the other hand, some traders may want to trade the AUD/JPY when the market is in an uptrend. When trading in this type of market, traders may want to use a sell indicator to help them identify when the market is in a good selling opportunity.

Best Currency Pairs to Trade in the Asia Session Trading Forex Market: When it comes to trading Forex, the most popular market to participate in is the Asia session. This is due to the high liquidity and active trading environment, which allows for easier execution of trades. When considering which currency pairs to trade in the Asia session, it is important to consider the current economic conditions of the respective country. For example, when trading the Japanese yen, traders should keep an eye out for news that could impact the country’s economy. Similarly, when trading the Chinese yuan, traders should keep an eye out for political developments in the region. This is particularly important as the yuan is the second most traded currency in the Asia session. In order to help traders make informed decisions when trading in the Asia session, a popular sell indicator to use is the RSI. This indicator can help identify when the market is in a good selling opportunity. Overall, when trading in the Asia session, it is important to keep a close eye on the current economic conditions and political developments in the region. By doing so, traders can maximise their

chances of profitable investment outcomes. When looking to trade currency pairs in the asia session trading forex market, it is important to consider both economic conditions and political developments in the region. This way, traders can maximise their chances of profitable investment outcomes. As economic conditions in the region change, so too will the value of the currencies involved. For this reason, it is important to stay up-to-date on all the latest news and developments, in order to make the best decisions when trading currency pairs. In recent months, there have been a number of important political developments in the Asia-Pacific region. These include the election of Donald Trump as US president, as well as the subsequent withdrawal of the United States from the Paris Agreement on climate change. As a result of these events, there has been a move towards protectionism in many Asian countries. This has led to a increase in the value of the Chinese renminbi, Japanese yen and Australian dollar, among others. On the other hand, the Brexit vote in the United Kingdom has had a relatively small impact on the value of the British pound in the asia session trading forex

he Tokyo Forex session runs from 9:00am to 7:00pm Japanese Standard Time. The Japanese yen is the primary currency traded in the Tokyo Forex market. Forex traders in Tokyo should expect volatile trading conditions throughout the day as market conditions fluctuate quickly. Trading Tips for the Tokyo Forex session: 1. Follow the flow of the market: Forex traders in Tokyo should always stay up to date on market conditions and trade accordingly. However, it is also important to keep a level head and not overreact to small changes in the market. If you can, try to stick to simple, consistent trading strategies and avoid getting caught up in the excitement of the market. 2. Wait for opportunities: The Tokyo Forex market is highly volatile, and it can be difficult to find consistent, profitable opportunities. patience is key in this market. If you see an opportunity, wait for the right price to enter the trade, and then hold on to it. Don’t overextend yourself and become emotionally attached to your trade.

You don’t have to trade every day, but you should be prepared to trade at least once a week. One of the most common mistakes people make when trading Forex is over-extending themselves. Over-extending can lead to emotional attachment to a trade, which can actually cause you to lose money. In order to make profitable Forex trades, you should trade usually at least once a week, but you don’t have to trade every day. Just be prepared to trade and keep a tight grip on the trade, so you don’t over extend yourself and lose your profits.